- Use at least $10 billion of the state’s budget surplus for property tax relief

- Speed-up tax rate compression to lower school district M&O rates, providing relief for ALL property taxpayers

- Eliminate local taxing authorities’ loopholes by requiring two-thirds voter approval for all tax increases

- Increase the business personal property tax exemption to $100,000 to support small businesses

- Require all local bond issues and tax rate elections to be on the November ballot and approved by a two-thirds supermajority of voters

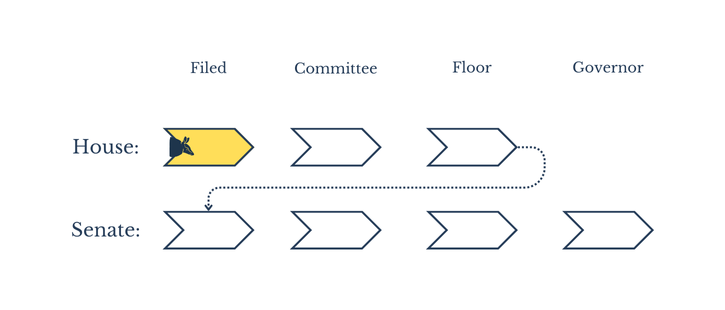

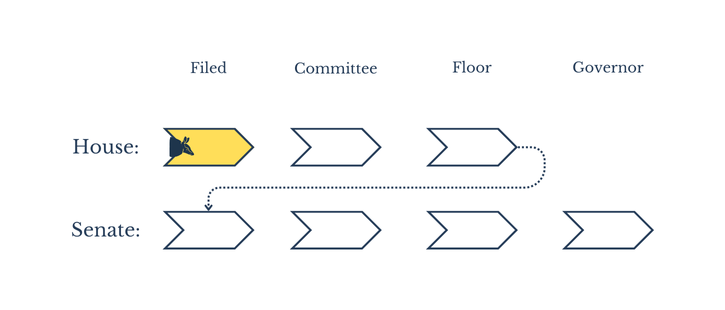

House Bill 218 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Carrie Isaac (R)

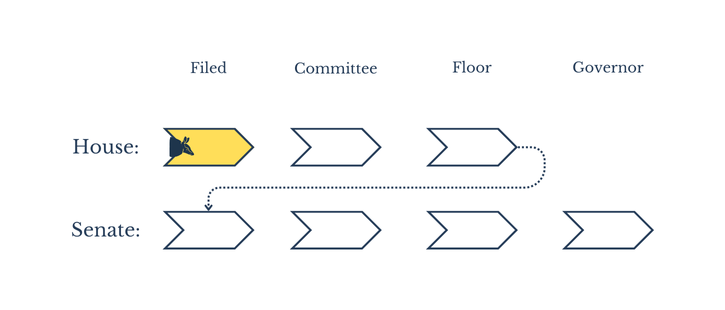

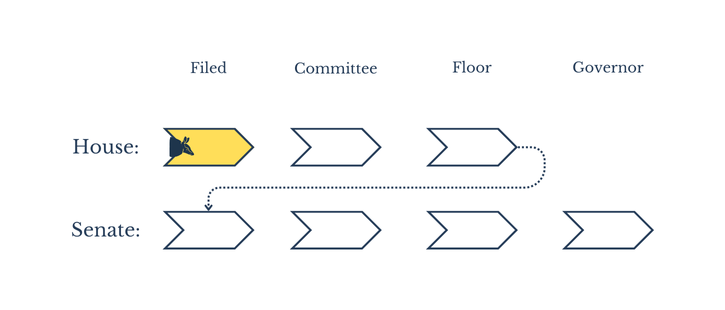

Status:

- Filed 11.12.2024

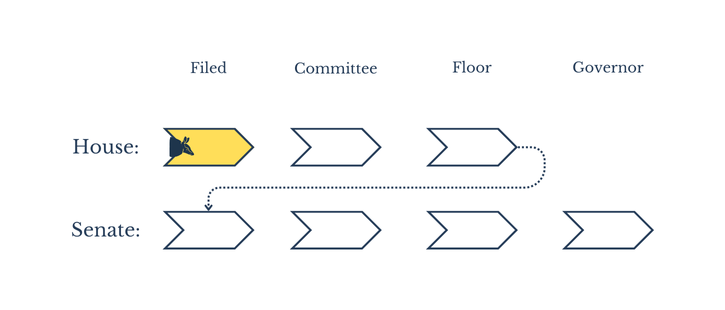

House Bill 228 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Cecil Bell Jr. (R)

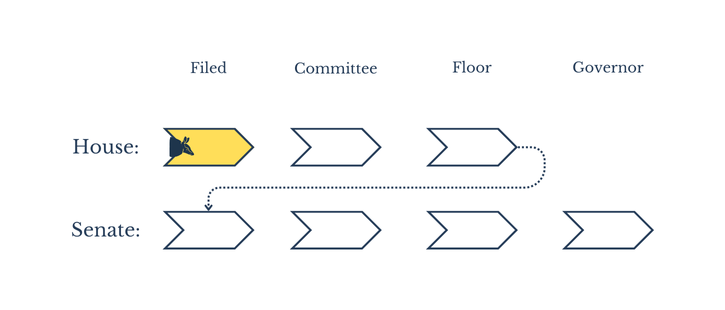

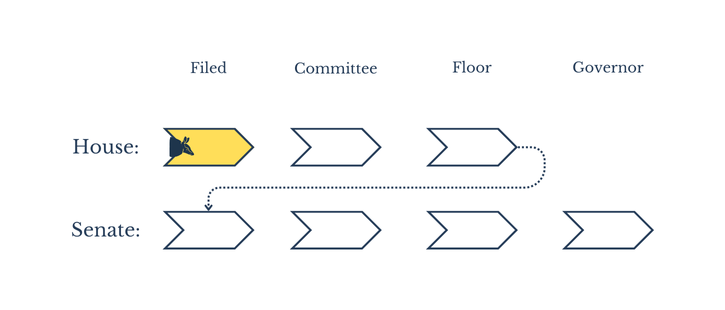

Status:

- Filed 11.12.2024

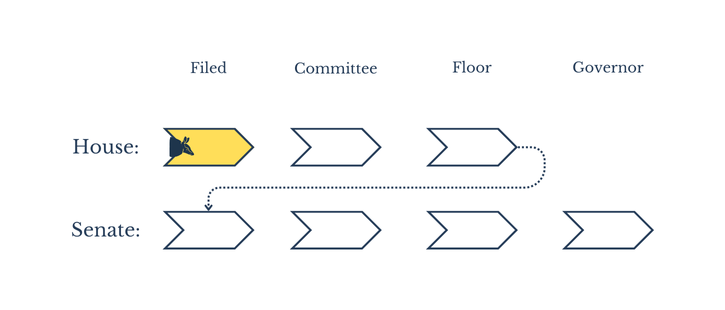

House Bill 264 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Keith Bell (R)

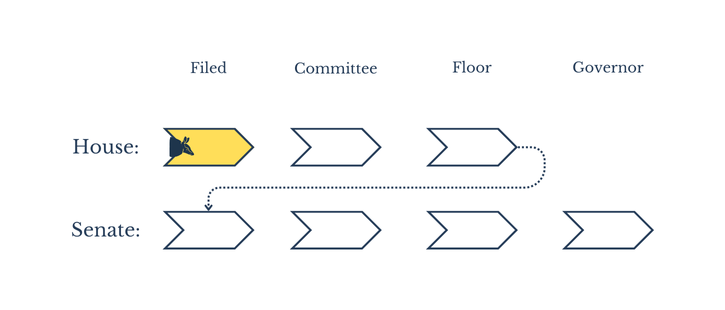

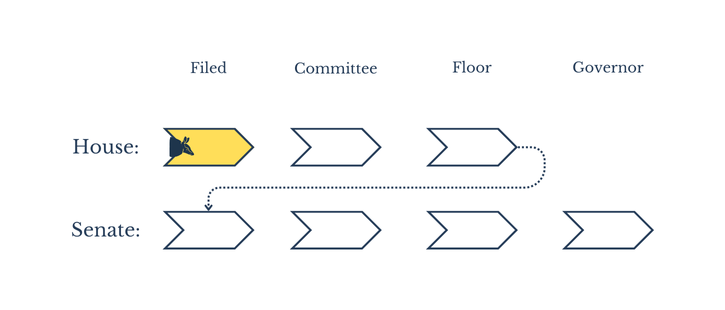

Status:

- Filed 11.12.2024

House Bill 275 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Briscoe Cain (R)

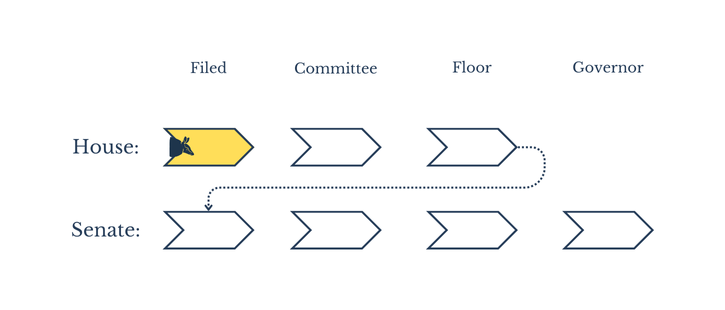

Status:

- Filed 11.12.2024

House Bill 1030 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Matt Shaheen (R)

Status:

- Filed 11.12.2024

House Bill 1553 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Steve Toth (R)

Status:

- Filed 12.9.2024

House Bill 2743 – Using Budget Surplus to ‘Buy-Down’ School M&O Property Taxes

State Rep. Helen Kerwin (R)

Status:

- Filed 12.12.2024

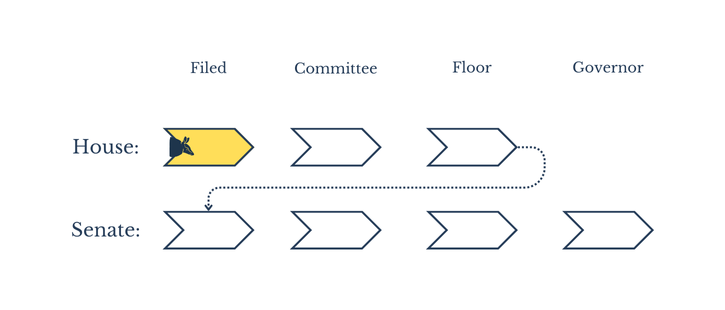

House Bill 763 – Disaster Loophole Elimination for Property Tax Rate Hikes

State Rep. Briscoe Cain (R)

Status:

- Filed 11.12.2024

House Bill 1131 – Disaster Loophole Elimination for Property Tax Rate Hikes

State Rep. Tom Oliverson (R)

Status:

- Filed 11.12.2024

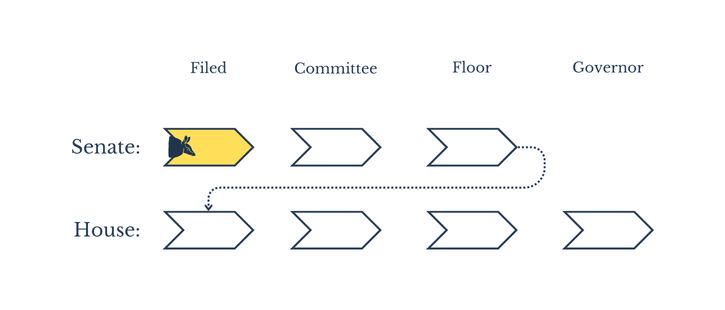

Senate Bill 1449 – Disaster Loophole Elimination for Property Tax Rate Hikes

State Sen. Paul Bettencourt (R)

Status:

- Filed 2.19.2025

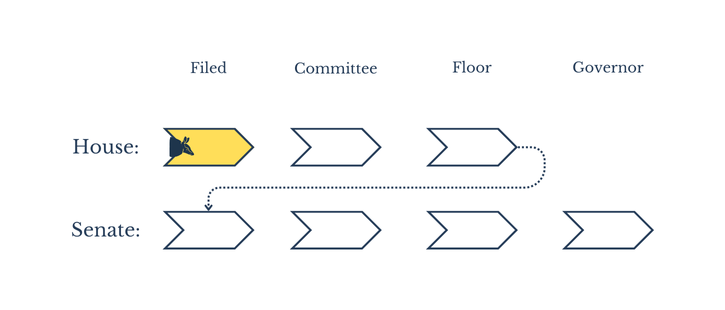

House Bill 2574 – Increase Voter Approval Threshold to 60% for Bond Elections

State Rep. Brian Harrison (R)

Status:

- Filed 2.7.2025

House Bill 2736 – Two-Thirds Voter Approval Threshold for Tax and Bond Elections

State Rep. Briscoe Cain (R)

Status:

- Filed 2.12.2025

House Bill 1519 – Bond Elections to Uniform November Election Date

State Rep. Mike Schofield (R)

Status:

- Filed 12.4.2024

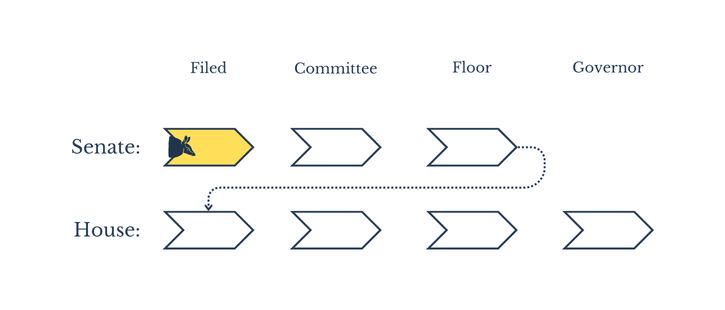

Senate Bill 533 – Bond Elections to Uniform November Election Date

State Sen. Kevin Sparks (R)

Status:

- Filed 12.5.2024

House Bill 2672 – Bond Elections to Uniform November Election Date

State Rep. Steve Toth (R)

Status:

- Filed 12.4.2024